This article was originally posted at Axel Standard, a platform for cloud accountants and SaaS applications.

Business owners tend to focus their attention on financial statements that show their profitability and cash flow with pay less attention to the information contained on the balance sheet. On the contrary, tax authorities look to the balance sheet when they suspect foul play has occurred with regards to the financial reporting by the business.

With strengthening compliance with tax regulations being at the center of the reform taking place in China, the Chinese tax authorities are now using key figures contained on financial reports to assess the probability a business is not in compliance with tax regulations. It’s increasingly common for businesses in China to find themselves non-compliant as a result of poor quality accounting methods, many of which have been somewhat tolerated in the past.

Adjusting balance sheet items that contain tax risks will often involve additional tax liability. However, this is far better than those adjustments are discovered during a tax audit. Then, not only will the adjustments be subject to additional tax liability based on the adjustable amount, but the business will be fined for being found to be non-compliant.

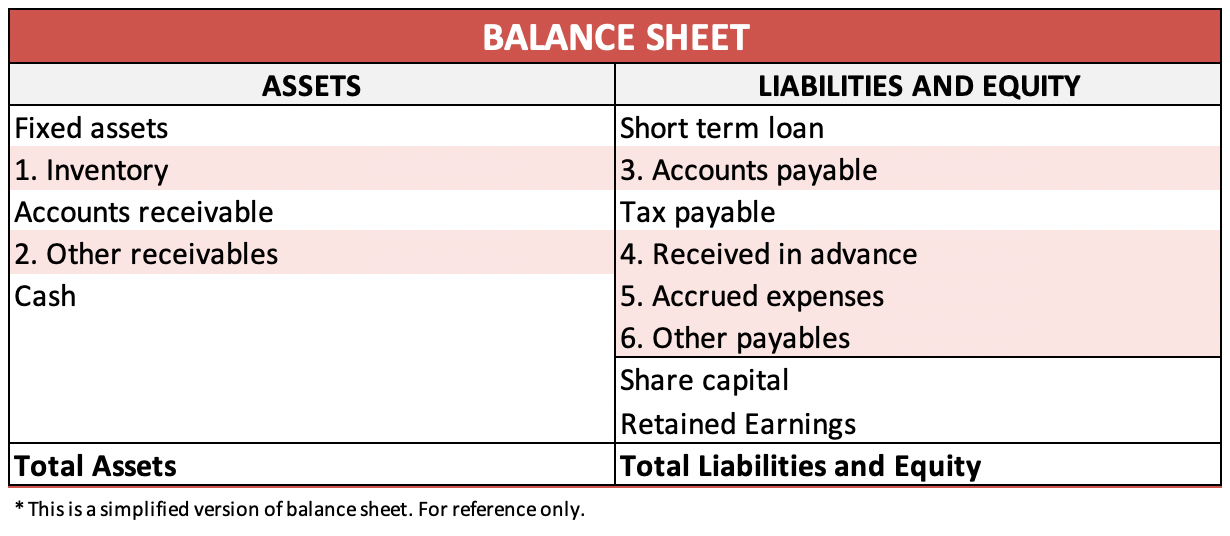

To avoid such scenario, business owners should learn how to identify tax risks by looking at the company’s balance sheet. To do so, we present a list of six balance sheet items that frequently contain potential tax risks so that you can self-diagnose your balance sheet and reverse those tax risks before the tax authorities do so on your behalf.

RELATED: Clean up Your Balance Sheet Part 2 – Case Study

Item 1: Inventory

Inventory/sales ratio continuously increases.

If inventory balances increase without a corresponding increase in sales revenue, it might indicate that some goods have been sold without recognizing revenue or issuing VAT Fapiao. During a tax audit, abnormally high inventory to sales ratio will likely lead the tax officer to check your physical warehouse.

“Theoretical Revenue” is much higher than actual revenue.

With the Golden Tax 3 system, tax authorities estimate the revenue your business should report based on multiple data sources. The tax authorities are automatically alerted if a business reports revenue which is significantly lower than the “estimated revenue” within a certain period. Estimated revenue figures are calculated using the following formula;

“Unused input VAT” cannot be reconciled with the inventory closing balance.

Having an inventory closing balance which cannot be reconciled with your unused input VAT is an indicator that you might have used the input VAT of the inventory (unsold products) to offset output VAT of the sold products. In this case, you have underreported your VAT and postponed your CIT liability, both of which are non-compliant with tax law in China.

Item 2: Accounts Payable

Input VAT Fapiao without actual purchase or payment.

Some businesses in China purchase input fapiaos as a way to overstate their expenses, thus, reducing tax profit and CIT payable. Since these expenses are never paid to any vendors, the payables for these fake expenses remain pending and accumulated in the “Accounts payable” category on balance sheet, making it one of the first places the tax authorities look when tax fraud is suspected.

Item 3: Accrued Expenses

Incorrectly accrued expense accounts.

Accounting law in China (PRC GAAP) requires accountants to accrue expenses without knowing the exact value in a balance sheet item specifically for accrued expenses. Once the true value is known (fapiao received), the accrued expense needs to reversed and correct values – as per fapiao – recorded in the balance sheet category related to the nature of the transaction. This very often leads to double or wrongfully booking, especially when the accountant is not familiar with the business. Over time, this can get very messy and during an annual CIT clearance, accrued expenses that have not been reversed are treated as non-deductible expenses and incur an additional 25% of CIT payable.

Item 4: Received In Advance

Revenue booked indefinitely as “received in advance”.

Whenever payments are received by a company without a corresponding output VAT fapiao, many accountants just book the amounts under the “Received in advance” category. Since not all transactions require a fapiao – such as goods for export – accountants that recognize revenue on the basis of fapiao (Fapiao Accountants) often do not recognize the revenue and they remain under the “Received in advance” category indefinitly. If this practice continues, the “Received in advance” balance becomes increasingly large over time, inevitably attracting the attention of the tax authorities. The business is – whether intentional or unintentional – concealing its revenue and under reporting it’s VAT and CIT.

Manipulate revenues to relieve cash flow.

This practice is often used by accountants when a business is experiencing cash shortages to relieve very tight cash flow situations. When the sales revenue is received, part of the amount is booked as “Received in advance” and the recognition of revenue postponed. This allows for postponing the recognition of revenue to a later period when the business has enough cash to pay the tax. Nonetheless, it is illegal to manipulate and postpone one’s tax liability. A large increase in the balance sheet item “Received in advance” will likely attract the attention of the tax authorities.

Item 5: Other Payables

Concealing revenue as a payable.

Another balance sheet item – similar to “Received in advance” – is the “other payables” category. Payment received for which a fapiao was never issued is often booked in the “other payables” category to delay or reduce VAT and CIT payment. When the ratio between other payables/revenue increases over time, this indicates fraudulent behavior.

Suspicious cross border transactions

Inter-company transactions – especially those which are cross border – such as expense recharges, expenses allocations (such as “overseas headquarter management fee”), short term funding between the overseas headquarter and the Chinese subsidiaries or among associated companies. These transactions are often scrutinized due to strict foreign exchange restriction in China. In order to settle the invoices charged from an overseas inter-company entity, the Chinese entity is either required to file and register with the State Administration of Foreign Exchange (SAFE), the procedure for which is very time consuming, or are restricted from transferring funds to the overseas entity as per tax regulations (such as headquarter management fees). As such, those overseas bills remain pending and accumulate in the “Other payables” category on the balance sheet for many years. A large “Other payables” category significantly increasing the likelihood that your business will be subject to a tax audit.

*Overseas payments and withholding tax is a complicated topic in China. You may read our next article for a detailed interpretation of the tax implications of this topic.

Item 6: Other Receivables

Long outstanding personal loan to shareholders

When company funds are given to shareholders not as taxable dividends or salary but as a personal loan, the amount is recorded on the balance sheet under “other receivables”. However, many business owners often borrow money from the company without any written contract and for an indefinite amount of time. If discovered, the loan will be treated as a dividend paid to the shareholder and subject to 20% Individual Income Tax and, depending on the circumstances, incur financial penalties for non-compliance.

Expenses reimbursement without relative supporting documents

When an accountant reimburses an employee for an expense claim without the necessary documents, that transaction will be treated as a cash advance to the staff and recorded on the balance sheet under “Other receivables”. The accountant is supposed to follow up with the employee and ensure they submit the supporting documents, mainly fapiaos. However, many expense claims go without the necessary supporting documents and remain in the “Other receivables” category on the balance sheet. A large “Other receivables” category greatly increases the risk a business will be subject to a tax audit and the potential financial penalty resulting from that audit.

Our Advice About Cleaning Up Balance Sheets

For tax authorities, the balance sheet is like a diagnostic report of the business. Evidence of fraudulent behavior and poor-quality accounting which results in the business underpaying its taxes are very likely to be contained within the balance sheet. Business owners should be able to look at their own balance sheet and assess whether the figures may or may not contain potential tax risks.

In case you find the balances of any of these 6 balance sheet accounts to be irregular, we suggest you ask your accountant for the breakdown of the relative figures. If a breakdown is not made available, it is likely that any adjustment will result in a costly tax adjustment to the business. However, beginning to reverse the tax risks contained on the balance sheet is a smart way to avoid additional financial penalty should the business be audited.

To help business owners better understand and self-diagnose their company’s tax risk by looking at the balance sheet, next week we will release a real case study demonstrating how bad habits and poor-quality accounting leads to balance sheet risks over time and what to do about it.